European aviation landscape: latest analysis

Michael Adams, Sales Director Europe at TrueNoord presents an in-depth analysis of the current landscape for the first quarter of 2024, delving into the intricacies of recovery trends, fleet dynamics and strategic decisions reshaping the industry.

As Europe inches closer to pre-pandemic air travel levels, a closer examination reveals a nuanced narrative of divergent recoveries across domestic markets, coupled with notable shifts in regional aircraft fleets and strategic leasing decisions amidst lingering concerns over engine maturity and financial constraints.

According to the International Air Transport Association’s latest air passenger market analysis, as of November 2023, Europe is now only 1.9 per cent behind November 2019 in Revenue Passenger Kilometres (RPKs) and 2.1 per cent behind in Available Seat Kilometres (ASKs) with an average passenger load factor at 83.7 per cent across European IATA members.

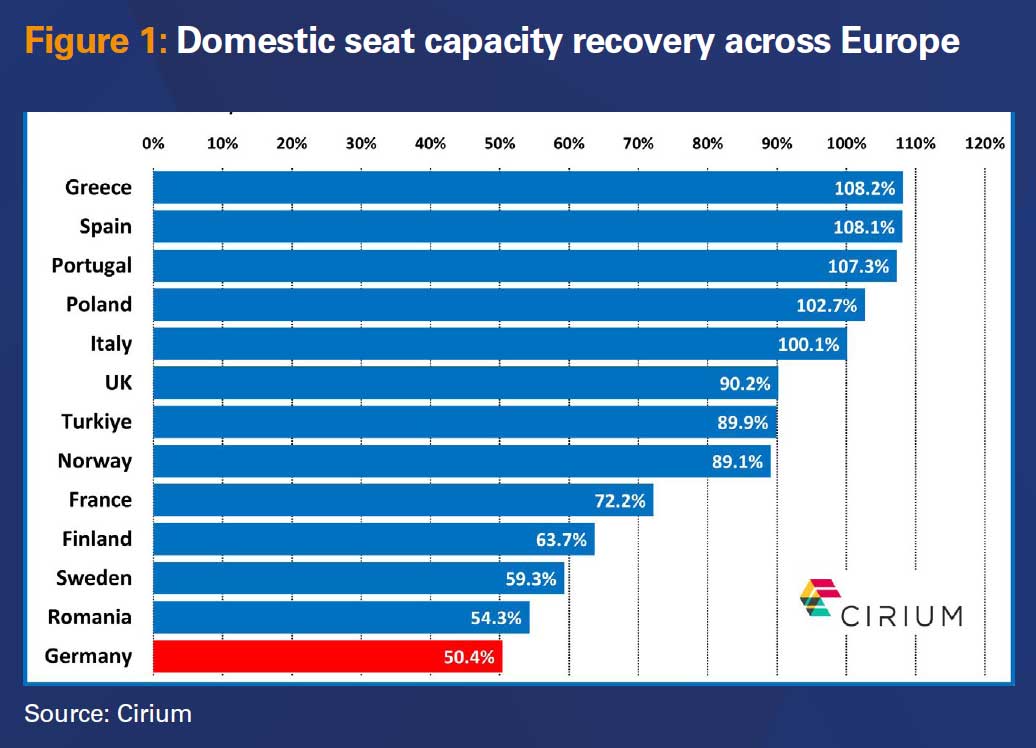

Domestic seat capacity

However, the picture is very mixed if you drill down into individual European domestic markets. Figure 1 presents currently offered domestic seat capacity for March 2024 as a percentage of capacity in March 2019.

It is notable that Germany is a laggard in the post-COVID-19 recovery of domestic European markets as leisure markets such as Greece, Spain and Portugal have seen a far stronger recovery.

A leading European regional operator recently revealed that they had seen only around a 40 per cent recovery of their ‘day return trip’ passengers post COVID-19. This could well provide an explanation as to why such markets as Germany, Sweden, Finland and France have seen a slower market recovery with a historically much greater proportion of business travellers who have now turned to online meeting functionality.

Turboprops and regional jets

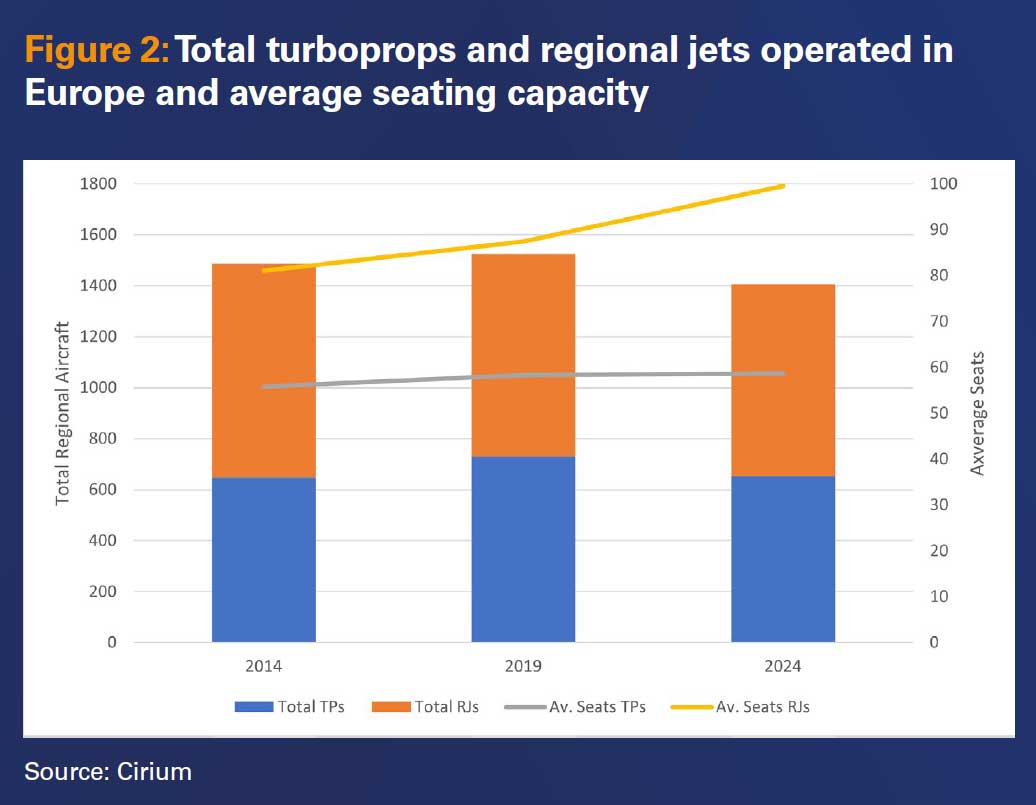

In respect to trends in regional aircraft operated in Europe, Figure 2 provides an overview of the total number of turboprops and regional jets in January 2014, 2019 and 2024. It also presents the average seat capacity across all turboprops and regional jets operated in Europe in each of these years.

With respect to turboprops, Figure 2 shows that the total fleet has increased by just under 1 per cent over the decade with average seat capacity increasing by just over 5 per cent.

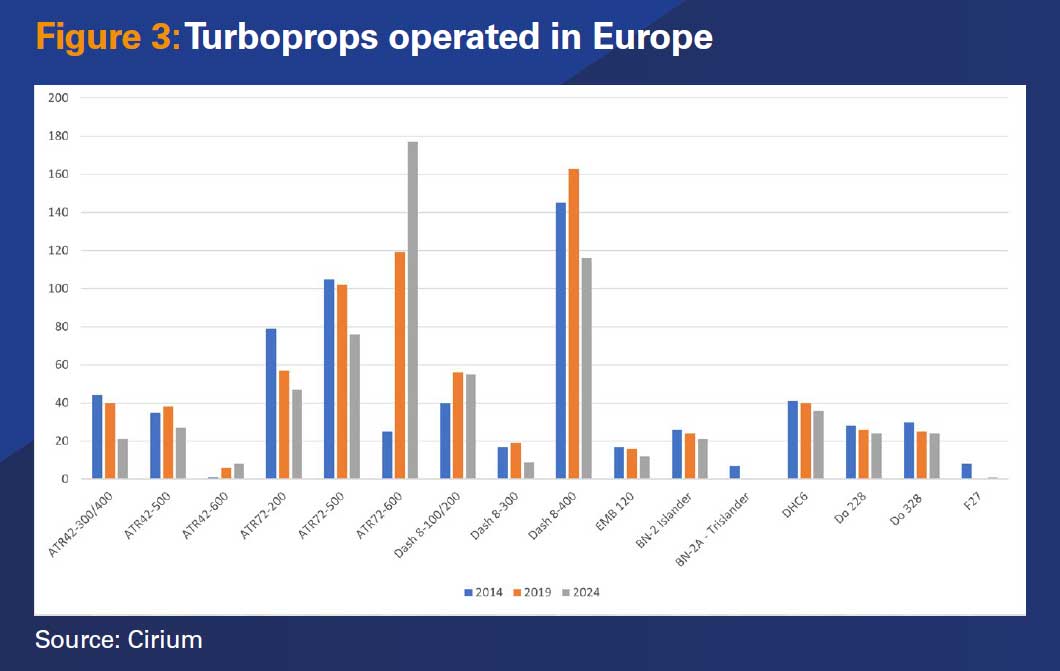

Figure 3 gives a breakdown of turboprops operated in Europe comparing 2014, 2019 and 2024. From this, the transition to newer technology turboprops in the past decade can be seen with a significant increase in the number of ATR 72-600s operated both as a consequence of the transition from ATR 72-500s as well as the replacement of Dash 8-400s by operators such as Aegean, the end of Dash 8 operations by others including airBaltic and LOT Polish Airlines and, of course, the demise of Flybe. The current pause in production of the Dash 8-400 and ever-reducing Maintenance, Repair and Overhaul availability and parts supply support in Europe has not helped the type.

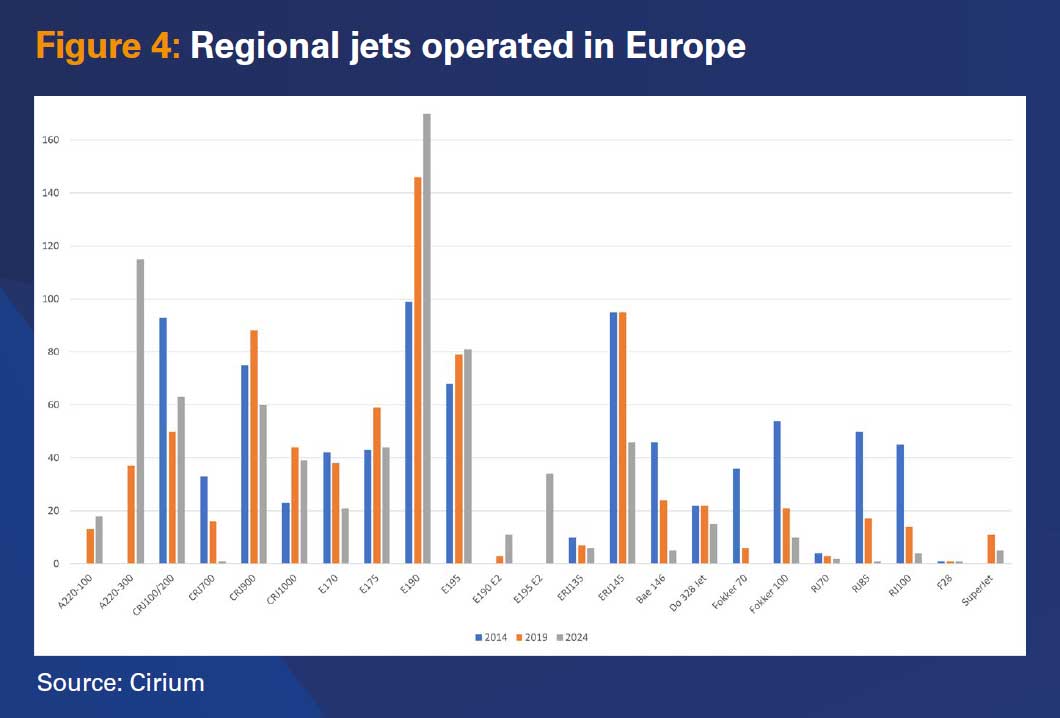

In the case of regional jets operated, the total fleet has fallen by just over 10 per cent in the past decade. However, this has been offset by the 22.9 per cent increase in the average seat capacity across all regional jets operated. Figure 4 provides a breakdown of the number of regional jets in Europe comparing 2014, 2019 and 2024.

Once again, the transition to newer and larger capacity regional jets can be noted over the decade. Strong growth in the number of E190s can be explained by the substitution of smaller capacity E-jets such as E170s by operators such as Air France HOP!, BA Cityflyer, LOT Polish Airlines and TAP Express.

In addition, A220-300s have seen a strong entry into service in Europe over the decade by operators including SWISS, airBaltic and Air France. Many of those operated in Europe have replaced smaller narrowbodies such as the A319.

A notable additional trend is the number of regional jet operators who have elected to extend leases on current generation regional aircraft rather than committing to next generation regional jets even though many of these operators had initiated Requests For Information from the Original Equipment Manufacturers pre-COVID-19.

Not only are many of these carriers extending their leases, they are also investing into their current generation regional jets. Cabins are being upgraded including new seats. Some have ordered seats that weigh only 50 per cent of those currently installed. These new slimline seats also allow increased seating capacity on the aircraft, some by up to 10 per cent. Although the seat pitch may therefore be reduced, the knee clearance remains the same as the current seat configuration.

Another factor that is also still impacting a number of the major regional airlines in Europe as they consider the significant capital investment into next generation regional jets, is constrained balance sheet. Many of these, often through their parent companies, are still encumbered with loans taken out during the COVID-19 pandemic.

While these may all be good reasons to maintain existing fleets, they also likely mask the single greatest concern of so many European regional airlines considering next generation regional jets. That concern lies with the engine type installed on both the A220 and E2.

It may be opportune for these operators to watch and wait for the engine to mature before they make their commitments. Based on the lease extension terms recently agreed by a number of European regional aircraft operators, many new aircraft commitments may not be made until the end of the current decade.

European outlook

In conclusion, the European aviation landscape in the first quarter of 2024 demonstrates varied trajectories, with recovery patterns diverging across domestic markets and significant shifts observed in regional aircraft fleets.

While Europe is nearing pre-pandemic air travel levels overall, the pace of recovery differs markedly among countries, reflecting distinct leisure and business travel dynamics.

As the aviation industry navigates through recovery and strategic decisions reshape operations, a watchful eye on market dynamics and technological advancements remains imperative for stakeholders to adapt and thrive in the evolving European aviation landscape.

Download the full article as PDF

Download the full article as PDF

Article courtesy of Regional International: https://www.eraa.org/publications/regional-international

13 March 2024