Regional Aircraft recovery? What’s really going on.

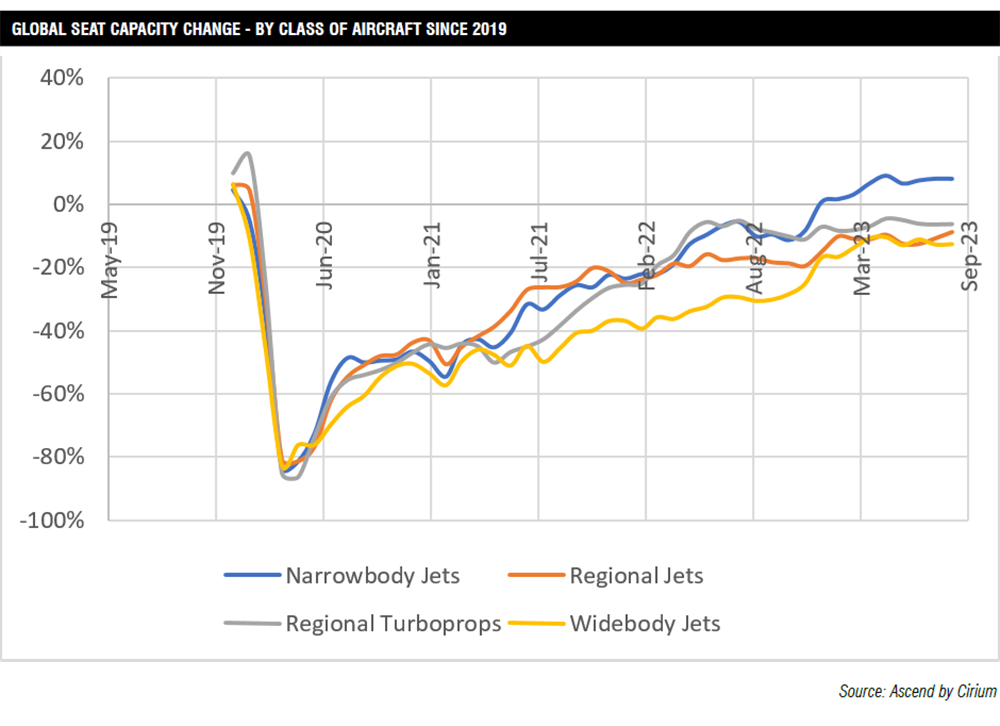

Having recovered more quickly or at a similar pace to other classes of aircraft in the postpandemic period, it now appears that single aisle aircraft have overtaken regional jets and turboprops since mid-2022, with twin aisles catching up fast. The chart alongside indicates that only narrowbodies have fully recovered to early 2020 levels and beyond, while widebodies and regional aircraft are still 5-15% below their pre-COVID-19 state. Having stagnated for a period from mid-2022, larger aircraft classes resumed their recovery trajectory from early 2023, but the smaller the aircraft, the slower the recovery became. However, does this differ according to geographical region?

Large turboprops – two speed recovery

Of the main markets, Asia has shown the strongest recovery reaching near 2019 levels. As the world’s largest market for current generation large turboprops up to 90 seats, this should not come as a surprise. In this region such aircraft provide connectivity where alternative modes of transport either do not exist or are too slow. Once COVID restrictions were lifted services needed to be restored ahead of other classes of aircraft, so since mid-2022 the Asian turboprop fleet has fully recovered. The same applies to Latin America and the much smaller African market where capacity now exceeds 2019 levels.

By contrast the mature markets of Europe and North America are still down by around 20% compared to 2019 levels.

So, is this difference driven by structurally lower demand, or supply factors?

In both Europe and North America (mainly Canada and north-western USA including Alaska) turboprops provide essential connectivity, so you would expect demand to be reasonably stable. In addition, the drive for greater sustainability should boost demand for turboprop connectivity as fuelburn and associated emissions are substantially less than similar capacity jets. We look to the fortunes of both ATR and de Havilland aircraft to provide some answers.

In both North American and European markets some carriers have (or plan to) shed some or all their Dash 8-400 fleets. In Europe this process was accelerated by the pandemic with the demise of Flybe and LGW’s Eurowings operation, plus the decision by Austrian, Air Baltic and LOT to phase out the type. The remaining operators are not materially growing their fleets to compensate, and new airlines like SkyAlps are only absorbing small numbers. In North America, Horizon’s disposal process is almost complete, and WestJet is seeking to reduce its relatively young fleet.

By contrast the ATR72 fleet is now fully recovered in Europe as well as in its smaller North American and African markets, especially its newest ATR-72-600 variant. ATR research reveals that its operators opened 150 new routes during 2022. This recovery is further supported by storage and availability data that shows inactive ATR levels close to pre COVID-19 levels. The main reason why some 120 of all ATR variants (excluding those that are in transition or maintenance related storage) remain grounded relates to either a lack of MRO capacity to restore their airworthiness, or the uneconomic costs of doing so.

This also means that ATRs could not replace much of the lost Dash 8-400 capacity even if operators wanted to. For example, much of the former Flybe network has not been replaced beyond a few key routes now operated by carriers such as Loganair. In North America, the ATR footprint is small and could not fill in the gaps vacated by the Dash 8.

Regional jets – variation by type

In the regional jet market, the overall capacity recovery rate was overtaken by single aisle jets from mid-2022 but, as is the case with turboprops, there are geographical differences. Asia, Africa, and the Middle East markets have recovered beyond 2019 levels, while remaining areas trail behind. North America, which represents by far the largest regional jet market, performed strongly during the pandemic, but stagnated from late 2021 and has only resumed growth during the latter part of 2023. This market is also dominated by smaller capacity jets up to 76- seats due to scope clauses that prohibit US regional capacity providers from operating larger aircraft.

However, the North American regional market has seen a gauge stepchange since the pandemic whereby US carriers have accelerated the retirement of the world’s largest 50-seat jet fleet. According to Ascend by Cirium capacity on this size of jet had reduced by 50% on 50-seater CRJs and 38% on ERJs by mid-2023. The active global fleet size of all sub-50 seaters is now under 700, compared to some 1,400 before the pandemic, and the vast majority have always been in the US. The active fleet of 70-seater regional jets now stands at 1,240 units, so if the 50-seat category of regional jets was stripped out of the overall global fleet, the trajectory over recent years paints a different picture that (according to Ascend by Cirium) shows a full capacity recovery back to 2019 levels for the E170/175 fleet.

In the larger, above 70-seat regional jet market, the global fleet is much more widely dispersed and has largely become the domain of Embraer, unless the A220 is included at the top end of this spectrum. Here, the capacity recovery stagnated from late 2021 until early 2023. During this year it has still not quite recovered to 2019 levels in most parts of the world although signs of a market boost can be seen in more recent months.

Throughout 2023, the lack of sufficient crews to enable recovery has been a major concern. This has been especially acute in North America where not only did crews leave the industry during the pandemic, but those that remained have often been recruited to fly larger aircraft at higher salaries, thereby compounding the shortage. Whilst this has primarily affected the 70-seaters in the US it has also been a concern in Europe, but more recent evidence suggests that this shortage may be beginning to ease in both major markets. However, staff shortages are not confined to crews.

The availability of qualified engineers is now becoming a larger problem than pilots. This is because training qualified engineers takes far longer than crews and means that a balanced level of supply and demand for such skills will take far longer to restore. Along with extensively reported supply-chain driven lead time delays at OEMS and parts manufacturers, this shortage of maintenance engineers limits the ability to both maintain and grow the regional jet and turboprop fleets in Europe and elsewhere.

At the same time, the faster than expected recovery in the narrowbody segment throughout 2023 has led to a shortage of serviceable aircraft. Initially this stimulated the demand for wet-lease

capacity, but that supply has also become increasingly exhausted. This has forced some airlines to seek extra capacity with smaller aircraft. This began with increased demand for the E195 as the largest aircraft in the Embraer E1 stable. However, the small fleet of under 200 aircraft is now fully in-service so some operators are now also acquiring the remaining E190 capacity. Given the well-publicised need for around 600 GTF engine shop visits in 2024 for the A320Neo fleet, it is likely that demand for E190s will increase further in 2024.

Conclusions and consequences for the large turboprop market

At a global level the regional aircraft market has still not fully recovered to pre-pandemic levels, yet many operators including regional airlines report load factors at all-time highs. This does suggest that other factors are inhibiting balanced supply and demand.

No single reason in isolation can explain this imbalance but a combination of Dash 8-400 retirements in the turboprop segment, the decline of 50-seater regional jets, the lack of sufficient alternatives, and the challenges of returning aircraft of any class to service, add up to a credible explanation. The fact that lease rates and values of used regional aircraft are heading north and that the demand for ATR72s has recovered to 2019 levels and beyond, further supports the thesis of tight supply.

For more information on the topic, download TrueNoord’s latest Regional Aircraft Market Reports.

Download the full article as PDF

Download the full article as PDF

Article courtesy of Airline Economics: https://www.aviationnews-online.com/airline-economics/

29 January 2024