ANALYSIS: The regional-leasing ownership shake-up

The sale of Abelo to an affiliate of Cerberus continues a recent trend of ownership changes across the regional aircraft leasing space.

Over the last seven months, two of the biggest regional-focused lessors – Nordic Aviation Capital and Falko – have changed hands. NAC was taken over by DAE Capital, while Falko was sold by Chorus to New York-based HPS Investment Partners in December 2024.

RELATIVE SCALE

If portfolio size is used as a measure of market reach, Cirium data shows that in 2024 NAC was the largest regional lessor, with 209 turboprops and E-Jets in service, storage or on order, followed by Falko with 202.

After purchasing of the bulk of NAC’s portfolio earlier this year, DAE Capital leapfrogged to the top spot with 260 regional aircraft, but this will change again following the Dubai-based lessor’s planned sale of 49 Embraer jets to Azorra. This looks set to place the US lessor among the largest regional players.

Chorus’s sale of Falko, meanwhile, came two-and-a-half years after its purchase of the platform in May 2022.

A shift in ownership of such proportions has not been seen within aircraft leasing since AerCap’s takeover of its next-biggest rival GECAS in November 2021.

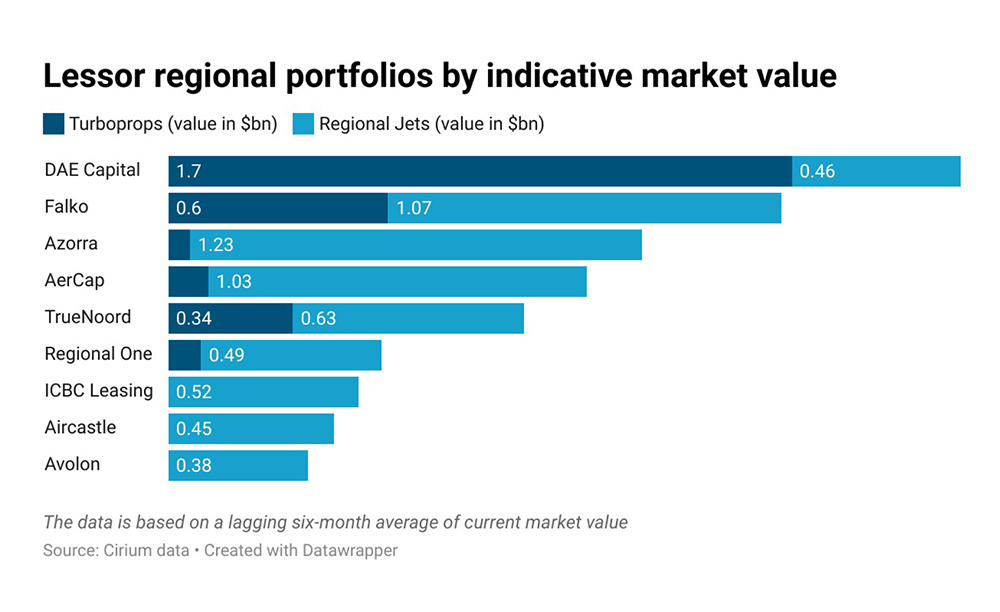

Size alone is arguably a limited metric for measuring a platform’s relevance in the market. By current market value, DAE’s regional assets are valued at $2.15 billion. Stripping out the regional jets bound for sale leaves an ATR portfolio valued at just under $1.7 billion.

Falko’s portfolio has a similar CMV, at $1.68 billion, and Azorra’s one of just under $1.3 billion, a figure that will rise when the NAC E-Jets are onboarded.

NORDIC SUNSET

The purchase of NAC by DAE earlier this year completes the dismemberment of what was prepandemic the world’s largest leasing platform by number of aircraft.

Cirium data shows that in 2019 NAC had a portfolio of 538 regional aircraft in service, storage or on order. This put it far ahead of the next-largest leasing portfolio: GECAS’s, with 226 aircraft.

However, the onset of the Covid pandemic forced the lessor into court-appointed restructuring in Ireland and a US Chapter 11 bankruptcy-protection process in 2021.

Amid those processes, chunks of the lessor’s portfolio linked to creditors’ claims were sold off or transferred to new management. NAC itself was transferred from founder Martin Moller’s control to that of creditors. In an ensuing sale process, DAE emerged as winner.

In an interview with Cirium, DAE chief executive Firoz Tarapore says the lessor’s interest in NAC arose from its ATR 72-600 fleet.

“We’ve consistently said publicly that we like the ATR 72-600 because it is a unique aircraft,” notes Tarapore. “It’s got unique characteristics, both from an operator and a lessor perspective. Before the acquisition, we had a strong market position, and adding to that market position with NAC’s presence in this space was the primary attraction for this acquisition.

“The only way to acquire NAC’s ATR 72-600 portfolio was to acquire the entire company at a prudent underwriting level and then find homes for the other assets in the company that didn’t fit well with our franchise.”

Tarapore describes the aircraft as the “only game in town” in the 70-seater market.

“The seat-cost and trip-cost advantage of the ATR 72-600 versus the Q400 (when it was in production) and regional jets and/or narrowbodies serving the 70-seater market is considerable,” he adds.

FROM ELIX TO ABELO

Oaktree’s involvement in the Abelo business can be traced back to the formation of its predecessor Elix Aviation Capital in 2013.

Then run by chief executive John Moore and head of commercial Scott Symington, the Dublin based lessor would spend the following decade building up a portfolio of ATR, Embraer, De Havilland Canada and Bombardier aircraft on lease globally, with capital provided by Oaktree.

It issued one of a small number of regional-focused asset-backed securities issuances in the form of ELIX PROP 2017-1.

Amid the pandemic, the lessor branched out into providing asset management services in 2021, but Elix’s tenure was almost up.

In 2022, the platform was merged with a recently formed business called Adare to create Abelo. Moore and Symington were replaced in their roles by chief executive Stephen Gorman and head of commercial Michael Hayden.

During the Paris air show in July 2022, Abelo ordered 10 ATR 72-600s and confirmed a previous deal, struck by Elix Aviation in 2019, for 10 aircraft of the ATR 42-600’s in-development short take-off and landing (STOL) variant.

At the time, Gorman said he planned to double the regional lessor’s portfolio.

Cirium data shows Abelo has 77 aircraft under management, placing it 11th in terms of market share.

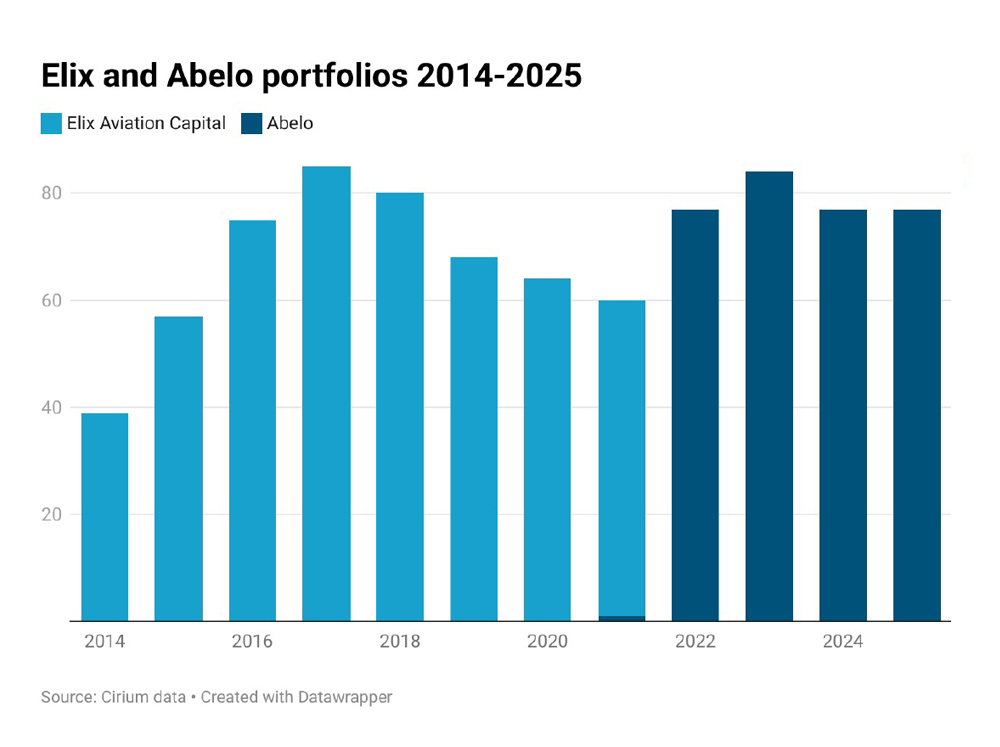

Elix grew its portfolio of in-service, stored and on-order units from 39 in 2014 to a peak of 85 in 2017, before falling to 59 in 2021.

It would appear that Gorman’s objective of doubling the fleet has yet to be realised. Abelo did grow its portfolio to 77 in 2022 and 84 in the following year, but fell back to 77 in 2024. These numbers do not reflect the level of churn within that portfolio of either company.

In its news release about the ownership change, Abelo quoted Gorman as stating: “With Cerberus as our new partner, we’re well positioned to accelerate our growth, deepen our customer relationships, and continue delivering solutions that support more efficient and sustainable air connectivity around the world.”

The regional lessor has also closed a new $750 million warehouse facility, the proceeds of which it says will help fund the next phase of its expansion.

One source says it was not a surprise that Abelo was sold, indicating that Oaktree had been assessing its options for some time.

Abelo has been contacted for additional comment.

PRIVATE EQUITY PLAYS

Cerberus is no stranger to the aviation sector, having in 2005 acquired Debis AirFinance, which was later renamed AerCap, and which it exited by share sales over time. The alternative fund manager is also a shareholder in Hamburg Commercial Bank, which made a brief foray into aviation finance last year and into this year.

Cerberus has also been active in the airline sector, historically owning a stake in Air Canada and making a bid in conjunction with EasyJet and Air France-KLM to take over Alitalia in 2018.

Separately, Oaktree continues to be actively involved across the regional-leasing space via its financial backing for Azorra and World Star Aviation.

One source says Cerberus had been looking at the regional space “for a little while” and had until now been “frustrated that they haven’t been able to get involved in it”.

The rationale behind a fund or lessor’s exit or entry from the regional space can be difficult to ascertain.

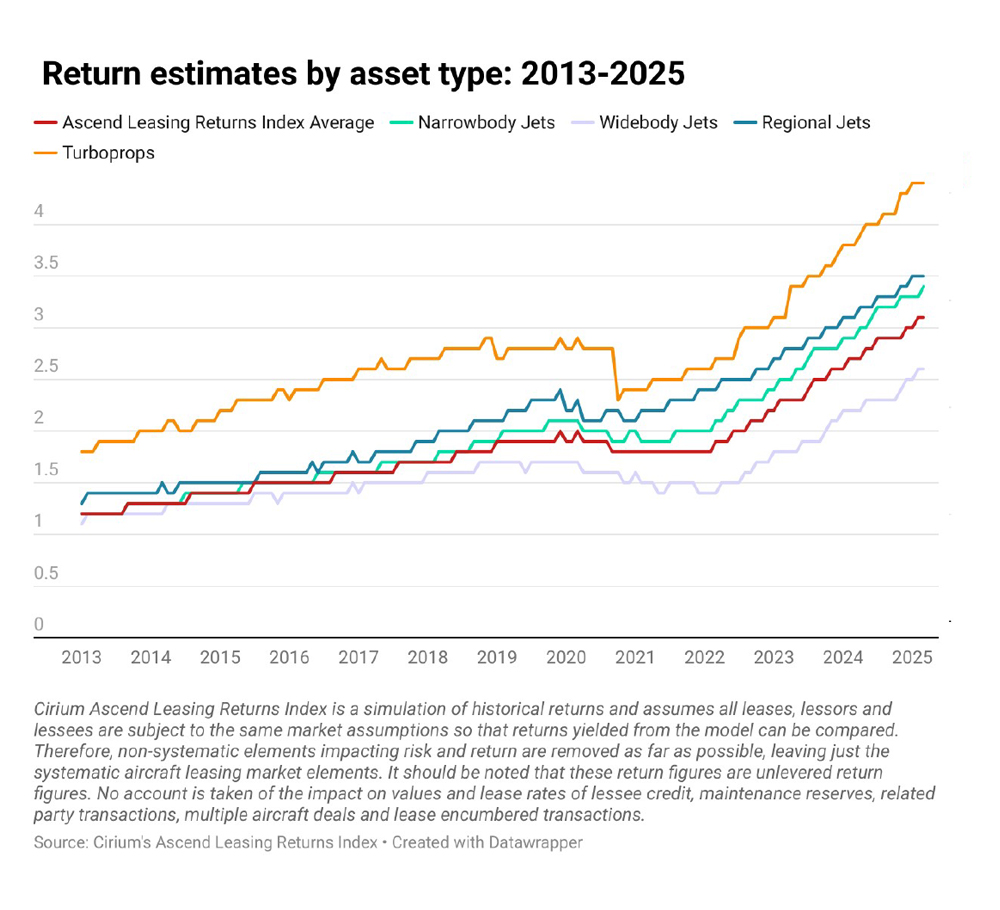

Data from Cirium’s Ascend Leasing Returns Index suggests that on a very broad basis, turboprops enjoy the highest return profile, followed by regional jets, narrowbodies and widebodies.

All asset classes have shown rising returns since the end of the pandemic. In March 2025, turboprops produced a 4.4% unlevered return, versus 3.5% for regional jets, 3.4% for narrowbodies and 2.6% for widebodies.

Anne-Bart Tieleman, TrueNoord’s chief executive, points out that there is less competition in the regional lessor space and fewer specialist platforms, “which is important”.

“It is a competitive market, but returns are okay, otherwise we wouldn’t be active in this part of the

market,” he tells Cirium.

“On the other hand, you have to work harder for a dollar asset, because instead of an aircraft costing $40 or $60 million, we are investing in aircraft that cost $20 to $30 million.

“And no matter the value, it costs the same in time and effort to complete on a transaction. So, in that sense you should make more on those deals, because it’s actually costs more in human capital to manage them.”

A source in the regional leasing space adds: “There’s so much money chasing around the narrowbody space, and it’s all getting squeezed. I think people are finally starting to twig that there can be some really attractive risk-adjusted returns in the regional space”.

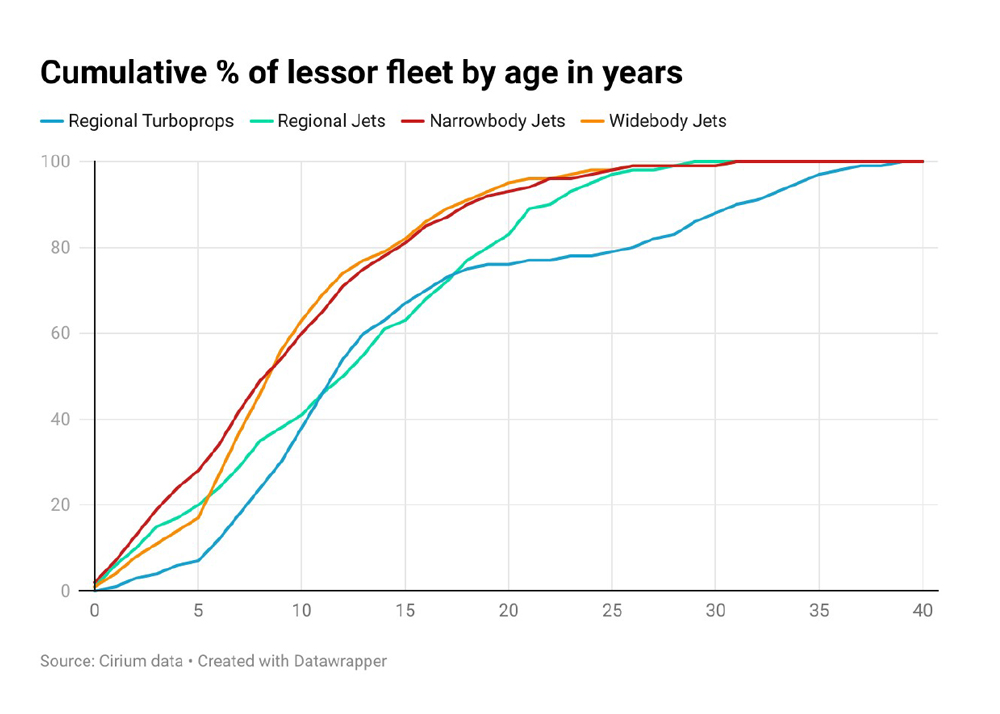

The person observes that the regional lessor fleet tends to be older on average and include more out-of-production models than the narrowbody market, and suggests end-of-life and part-out considerations are playing a greater role in regional lessors’ thinking.

This would appear to be backed up by Cirium data, which shows a higher percentage of older equipment in the E-Jet and turboprop space.

Tieleman sees regional types as having the advantage of holding value for longer.

“Maybe it’s due to the nature of the business, but airlines keep regional aircraft flying slightly longer. It’s a very standard product: an ATR flying in Indonesia is the same as an ATR flying in Florida.

“So, you often don’t need to reconfigure the product. You can of course have business-class and even first-class seats, but you don’t see many airlines doing that. It’s generally all very standard. So, moving aircraft around, keeping them in the air and of interest to airlines, is maybe easier than for narrowbodies, and is definitely easier than for widebodies.”

Tieleman highlights this versatility with the example of a 20-year-old ATR turboprop in passenger configuration which TrueNoord converted into a freighter and operated for a further nine years before selling it in 2024.

He says regional lessors can therefore easily handle these assets “from cradle to grave”, adding: “This is how we make our money.”

Another reason Tieleman cites for the long active life of regional assets is that there are fewer potential trading partners.

“In the narrowbody space, you have specialists that focus on green time-lease, or end-of-life or midlife assets. There is of course trading going on in the regional sector, but it’s relatively less than in the narrowbody market,” he surmises.

One leasing executive involved in the space does not see a particular trend behind the ownership changes of regional lessors.

“The biggest challenge for an owner of a regional leasing platform is to get their heads around the fact that the ceiling for growth is fairly low – you’re going to bump into it fairly quickly. Without a broad-based platform, the volatility can be quite high if not enough thought has gone into curating the credit profiles of lessees.”

In the case of Chorus’s sale of Falko, the source suggests, the Canadian company may have run out of patience after concluding that its investment had not worked out.

Briefing analysts on the sale in 2024, Chorus chief executive Colin Copp described the transaction as compelling.

Copp spoke of the “appropriate value” of Chorus’s regional leasing business as being a 7x multiple of equity value to EBITDA, or around $900 million.

But based on Chorus’s then prevailing share price, the Canadian company’s market capitalisation would have stood at only $540 million, which “demonstrates that we’re receiving a negative valuation for just the RAL [regional aircraft leasing] business alone”, Copp observed.

He said that selling Falko and regional business for an aggregate consideration of $1.9 billion ($814 million in cash plus $1.1 billion of aircraft debt assumed by the buyer) delivered a price to book of 0.84x, which “aligns closely with our publicly traded peers in the aircraft leasing space”.

Article courtesy of Cirium: https://www.cirium.com

17 June 2025